Empowering financial growth

Google Employees

Everyone has their financial goals, but not everyone knows how they will get there.

- How much risk should I take to reach my goals?

- Do I have enough to retire and at what age?

- How do I save for my children’s education and my retirement at the same time?

- How can I be as tax-efficient as possible?

These are all valid questions, and fortunately, we have the answers.

Twin Peaks Wealth Advisors LLC is not affiliated with Google or the Google benefits department. Twin Peaks Wealth Advisors has personal financial planning relationships with multiple clients who are Google employees.

What Our Clients At Google Say We Bring To The Table

Accountability Partner

- Take Action | Stop Procrastinating | Improve Motivation

- Set Deadlines | Make Progress

- Greater Perspective & Confidence

Maximize Opportunities By Staying in the Know

- Latest Trends and Investments

- Consider Changes in Tax Landscape

- Gain Access to Private Investments

- Minimize Risks

More Time On Your Calendar

- Focus on Your Personal Life

- We Set Meetings

- Discuss Any Changes

- Remain on Track

A Professional Process to Manage Your Finances

- Assess Current Situation

- Set Realistic Goals

- Design Custom Plan

- Account For All Considerations

Avoid Common Mistakes

- Inadequate Diversification

- Not Taking Advantage of Tax-Advantaged Accounts

- Poor Investment Choices

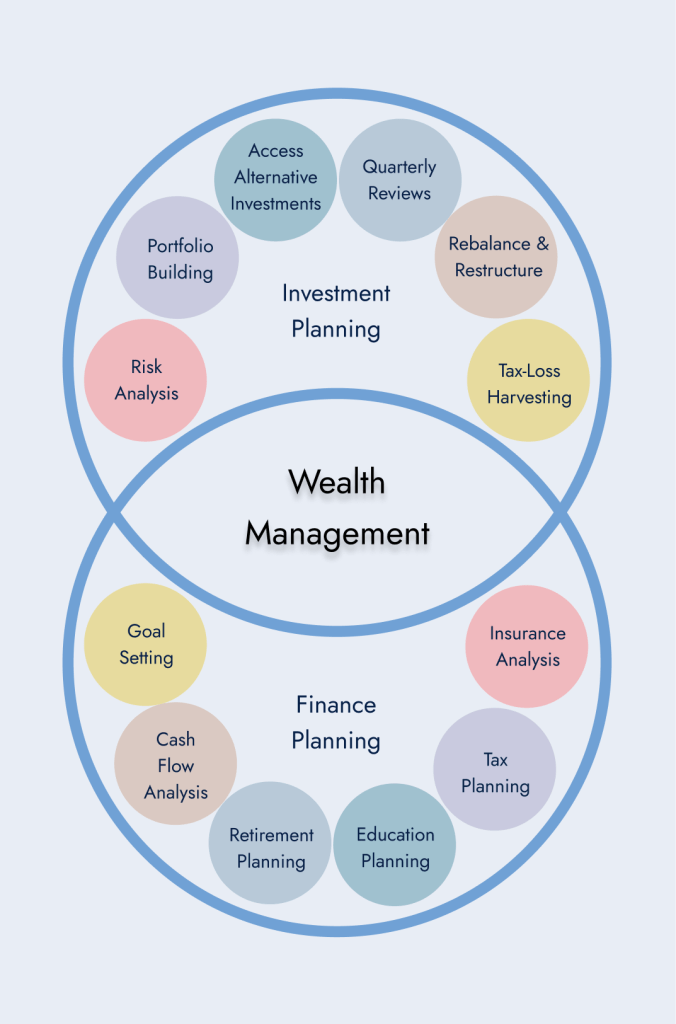

"Done For You" Ongoing Engagement | Wealth Management

Our most comprehensive offering with a 360 management of your finances.

- Financial Planning

- Ongoing Investment Management

- All other unique financial needs i.e. estate planning, special tax coordination, etc.

$2,000,000 minimum with TPWA

“Done With You” | A La Carte Packages

If you are requiring help on a specific area of your finances, the following flat-fee packages are right for you.

Essentials Package

Starting at $8,000 Family $6,000 Single

We deliver on this engagement

in 180 days or less

Goals & Cash Flow Planning

- Outline short, intermediate, and long-term financial objectives

- 5 year cash flow and savings projection (click the link to see a video of an example)

- Assistance with major purchases (i.e. home buying help)

Investment Planning

- Develop your concentrated stock liquidation strategy

- Build a go-forward investment plan for your future savings

- Investment portfolio analysis and recommendations to asset allocation and/or target date funds

- Fidelity 401(k) Brokeragelink

Equity Compensation

- Schwab stock plan optimization

Retirement

- Review retirement account contributions (IRA and Roth)

- Evaluate Fidelity 401(k) plan

- Retirement income forecasting and planning

Insurance & Family Planning

- Insurance planning (Life, Disability, Long-term care)

- Elect employee benefits & evaluate supplemental coverage needs

- Education and college funding

- Review custodial account contributions

Tax Planning

- Tax-return software analysis (Holistiplan report)

- Fidelity Mega Back Door Roth Contribution

- Traditional versus ROTH contribution analysis

- Roth IRA Conversion analysis

Complete Package

Starting at $10,000

We deliver on this engagement

in 180 days or less

*Designates Unique to Complete Package

Goals & Cash Flow Planning

- Outline short, intermediate, and long-term financial objectives

- 5 year cash flow and savings projection (click the link to see a video of an example)

- Assistance with major purchases (i.e. home buying help)

Investment Planning

- Develop your concentrated stock liquidation strategy

- Build a go-forward investment plan for your future savings

- Investment portfolio analysis and recommendations to asset allocation and/or target date funds

- Fidelity 401(k) Brokerage

- Alternative investment strategy (private equity, non-traded real estate, private credit, venture capital, hedge funds)*

Equity Compensation

- Schwab stock plan optimization

- Concentrated stock strategies & liquidation (10b5-1 planning)*

Retirement

- Review retirement account contributions (IRA and Roth)

- Evaluate Fidelity 401(k) plan

- Retirement income forecasting and planning

Insurance & Family Planning

- Insurance planning (Life, Disability, Long-term care)

- Elect employee benefits & evaluate supplemental coverage needs

- Education and college funding

- Review custodial account contributions

- Estate planning review – updating documents and beneficiaries as needed*

Tax Planning

- Tax coordination meeting with your accountant*

- Tax-return software analysis (Holistiplan report)

- Fidelity Mega Back Door Roth Contribution

- Traditional versus ROTH contribution analysis

- Roth IRA Conversion analysis

- Annual gifting & charitable giving*

Insurance & Family Planning

- Insurance planning (Life, Disability, Long-term care) (click for example analysis)

- Elect employee benefits & evaluate supplemental coverage needs

- Education and college funding (click for example analysis)

- Review custodial account contributions

- Estate planning review – updating documents and beneficiaries as needed*

Google Vesting Schedule (Monthly, Initial Grant Varies)

- January 25th, 2025

- February 25th, 2025

- March 25th, 2025

- April 25th, 2025

- May 25th, 2025

- June 25th, 2025

- July 25th, 2025

- August 25th, 2025

- September 25th, 2025

- October 25th, 2025

- November 25th, 2025

- December 25th, 2025

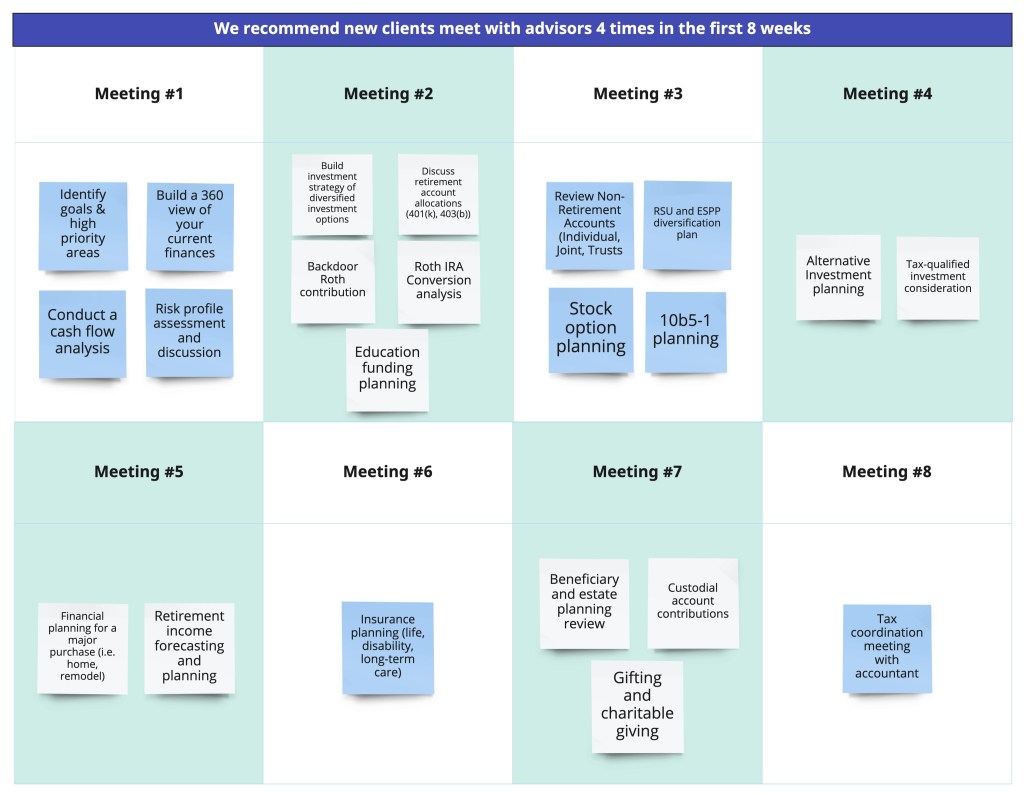

The First 3 Months - Complete

Please note that the below meeting structure is just an example. Meeting topics and frequency will be adjusted based on your specific situation.